Interactive Brokers, which was founded in 1993, offers a streamlined approach to brokerage services that emphasizes broad market access, low fees, and superior trade execution. Customers can use a single integrated account to trade stocks, options, futures, currency, bonds, and funds across 135 markets. You should know about interactive brokers’ minimum deposit review.

Professional traders and intelligent, active traders who wish to take advantage of a robust suite of tools and global access to a wide choice of assets will find Interactive Brokers to be one of the finest brokers. You should know about Interactive Brokers to see if it’s the appropriate fit for your investing requirements.

Who should use Interactive Brokers?

Institutional investors and sophisticated, active traders who want a robust trading platform and access to various asset classes may consider Interactive Brokers. The broker has tried to appeal to a broader audience by delivering new products, services, and educational content geared at less active traders and investors.

What is the usability of Interactive brokers?

In recent years, the Interactive broker onboarding procedure has become more user-friendly. You can even open an account without immediately funding it. The website is well-designed, and the Client Portal and IBot (an AI-powered digital assistant) can aid you in locating the information you require. Interactive Brokers offers a variety of trading platforms, including desktop, online, and mobile apps for Android and iOS devices. The app is essentially identical to the web platform, albeit neither is as powerful as the company’s flagship trading platform, Trader Workstation (TWS).

Know about the Work Experience of Interactive brokers

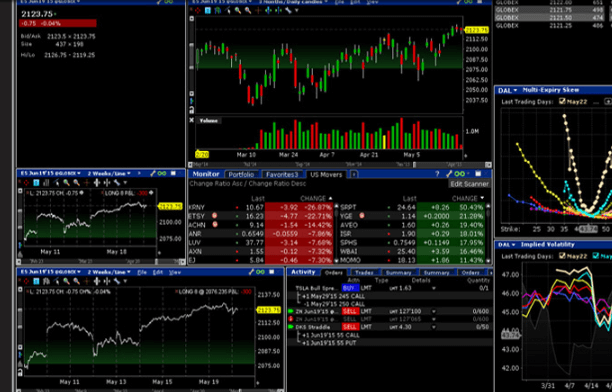

The Client Portal at Interactive broker is a convenient way to keep track of your positions, obtain a real-time picture of your accounts, and make basic transactions. It is simple to get a hold of a trade ticket and configure trade defaults. However, most investors who want to get the most out of their Interactive Brokers account will use Trader Workstation.

The Interactive broker has many more features and is meant for aggressive traders and investors who need a lot of freedom and want to trade several different goods. You may set up hotkeys to swiftly place orders, and you can also queue orders for later execution, either single or in batches. You can submit a conditional order that becomes active once specific criteria are met, such as when an existing order executes, or you can select a date and time for an order to be communicated. You can even use TWS to place orders through an application.

Key points about interactive broker’s minimum deposit

- In the trading and low-cost award categories, Interactive Brokers consistently receives top marks.

- Interactive Brokers offers a diverse selection of asset classes.

- IBKR is a sophisticated trading platform that includes intense technical and fundamental research.

Final thoughts

Interactive Brokers is a well-known trading platform for internet brokers. On the other hand, many potential customers are put off by the multiple minimum deposit options accessible. You should know about Interactive Brokers minimum deposit amount and additional valuable information regarding the platform, such as the account opening process and payment options.

Most users and trading activities at Interactive Brokers do not require a minimum deposit. This is an excellent broker to work with, especially considering that most internet brokers need a minimum deposit. Interactive Brokers could be a good choice for you if you’re a new trader with little funds.